- Subscribe to RSS Feed

- Mark Post as New

- Mark Post as Read

- Float this Post for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

Quoted price per point of fixed 78 pts per $1 is NOT correct.

Southwest uses a sliding scale. You can only estimate a value of points but it is subject to change. A general principle is that it starts at about 1/60 and goes up from there, but the more expensive flights do assess a much higher ratio of points per dollar. In this way, Southwest does well to ensure that its more discretionary customers try to pay cash for seats on full flights, but save their points to use on cheaper flights with plenty of available seating. As such, Southwest was able to rid itself of the hefty blackouts of RR1.0, and develop a compromise that allows customers to redeem rewards at any time, but to pay a premium for that flexibility.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

@hykos wrote:Quoted price per point of fixed 78 pts per $1 is NOT correct.

Southwest uses a sliding scale. You can only estimate a value of points but it is subject to change. A general principle is that it starts at about 1/60 and goes up from there, but the more expensive flights do assess a much higher ratio of points per dollar. In this way, Southwest does well to ensure that its more discretionary customers try to pay cash for seats on full flights, but save their points to use on cheaper flights with plenty of available seating. As such, Southwest was able to rid itself of the hefty blackouts of RR1.0, and develop a compromise that allows customers to redeem rewards at any time, but to pay a premium for that flexibility.

Unfortunately, there's some incorrect info and/or a bit of misunderstanding here.

78 points per $1 is the current redemption rate.

This is the exact formula by which Southwest prices points flights. Points fares are equal to the base fare (exclusive of taxes and fees) x 78.

When Southwest first shifted to "RR 2.0" in 2011, the redemption rate was initially set at 60/$1 (for WGA fares, BS and AT had their own, higher redemption rates). Then it was increased to 70/$1 in 2014. In 2016 it was announced that the rate would be variable, and fares were offered for between 72/$1 and 80/$1. There was some brief availability of 55/$1 fares, and occasionally some other random rates. Most currently, in 2018 we learned that all fares types (WGA, BS and AT) would be offered for the same points redemption value, which is currently 78/$1. This was another devaluation of the WGA fare, but represented a better redemption ratio for BS and AT, making using points to book those fares more attractive. (Which coincides with greater occasional unavailability of WGA fares in general.)

This value is the constant that Southwest uses to calculate points fares. We use it to check if there's been any program devaluation by Southwest.

It's important to understand that this value is different from the realized value of a Rapid Rewards point.

This can be confusing to understand for some, because the realized value of a Rapid Rewards point does vary.

Points fares do not trigger the collection of taxes, so lower priced flights are a "better value" than higher priced ones when you use points. The percentage of the total cash fare represented by taxes is greater on lower priced fares, so, by using points, your "savings" (when compared to the cash fare) is greater. Which makes the realized value of those points larger. This is why bloggers will often refer to the value of a Rapid Rewards points using a range -- for example, 1.4 to 1.9 cents.

Remember though, that the formula for pricing those points fares remains -- at least until the next devaluation is implemented -- at 78/$1. 😉

To check this for yourself, just look at the base fare of any cash flight and compare it to the points price.

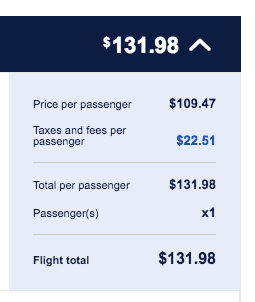

Cash fare: $132

Points fare: 8539

Base fare: $109.47 x 78 = 8538.66 ( rounded to 8539)

With regards to some other points you've made: It is somewhat unique to Southwest that the best redemptions are often short-haul or inexpensive flights, vs longer / higher priced ones, as is the case with most frequent flyer programs.

The original Rapid Rewards program was simply not sustainable as the carrier grew, so the "compromise" necessary to eliminate the capacity controls (which were a symptom of the program's inability to scale appropriately) was made by the introduction of the cash-based program -- with earning and redemption directly linked to the cash fare.

Since that's directly scalable, that should have fixed things for a while. But unfortunately, the rapidly ensuing and repeating devaluations indicate that that program was still more expensive than Southwest would like. And I suspect another devaluation is somewhat inevitable.

- « Previous

-

- 1

- 2

- Next »

-

No related discussions